AMZN Stock Poised for Long-Term Rally – TipRanks.com

Amazon (AMZN) is still in a correction phase and looks set to offer a buying opportunity ahead of a long-term rally. The technology giant is on track to achieve a market capitalization of $2 trillion. I am optimistic because of the growth of e-commerce, cloud computing, and online marketing, as well as the steady growth of revenue and income. These factors should push the stock higher, suggesting a promising long-term investment opportunity.

Amazon Accelerates Cloud Computing Revenue

One of the reasons why I am bullish on this stock is AWS (Amazon Web Services), its cloud computing platform. AWS is widely used by enterprises and small businesses for storing important data and files. It also supports the development and operation of various applications. As the leader with nearly a third of the total cloud market, AWS is well positioned to benefit from the growing demand for artificial intelligence (AI) products and services.

In the second quarter of 2024, AWS revenue grew 19% year over year to $26.3 billion. This highlights an annual growth of more than 17% in AWS revenue in Q1 2024 and 13% in Q4 2023. This shows that the growth rate of AWS revenue is increasing.

AMZN Stock Market Continues to Win

Another reason for my bullishness on AMZN stock is its Distribution Services. In addition to strong performance on its cloud platform, Amazon’s growing ad revenue supports my positive outlook. Advertising offers attractive profit opportunities because it costs less to run ads compared to the cost of delivering products to consumers.

The company reported $12.8 billion in ad revenue during the second quarter, marking 20% year-over-year growth. Interestingly, this growth rate is higher than that of Alphabet’s ( GOOGL ) ad network, where ad sales increased 11% year over year to $64.6 billion in Q2.

Going forward, any unfavorable development in Google’s antitrust case could help Amazon gain more market share in the ad industry. Last month, Google lost a landmark, years-long antitrust battle with the Justice Department that claimed Google abused its power over search and text marketing.

Overall, advertising presents a strong long-term opportunity for Amazon. The company promotes ads across its online marketplace, Twitch, streaming services, and other platforms. Additionally, increased advertising revenue could help offset slower growth in online and physical retail sales, which are single digits for several segments.

Amazon reigns as the E-Commerce Leader

My positive view of Amazon is well supported by its strong e-commerce business, which is its primary revenue driver. Along with purchasing products and services on its online marketplace, users interact with ads and connect to other Amazon offerings, such as Prime Video, while shopping.

The company’s status as a top e-commerce choice has made it a popular destination for many online shoppers. This gives Amazon an edge over competitors whenever it launches new products or services. In addition, its online market continues to grow domestically and internationally.

In Q2, Amazon reported a 9% annual growth in sales in the North American segment, which totaled $90 billion. Meanwhile, its revenue in the International Markets segment reached $31.7 billion, up 7% year-on-year. Additionally, the company’s 10th Prime Day was its largest ever, reflecting continued strong demand. It has also reached its fastest delivery speed for Prime Members in the first half of 2024.

Amazon’s Rising Profit Margins Signal Growth

Amazon’s growing profit margins and stable long-term dividends support my view of the stock. The company nearly doubled its revenue year-over-year, achieving a 9% profit in Q2 2024. Increased adoption of AWS and growing advertising revenue are likely to increase profit margins.

Also, improved profit margins in several sectors have led to better valuations. AMZN stock currently has a P/E ratio of 43, which is expected to decrease further.

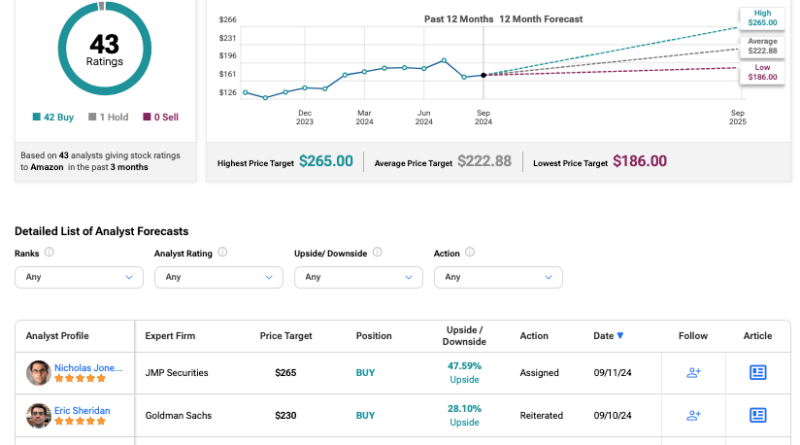

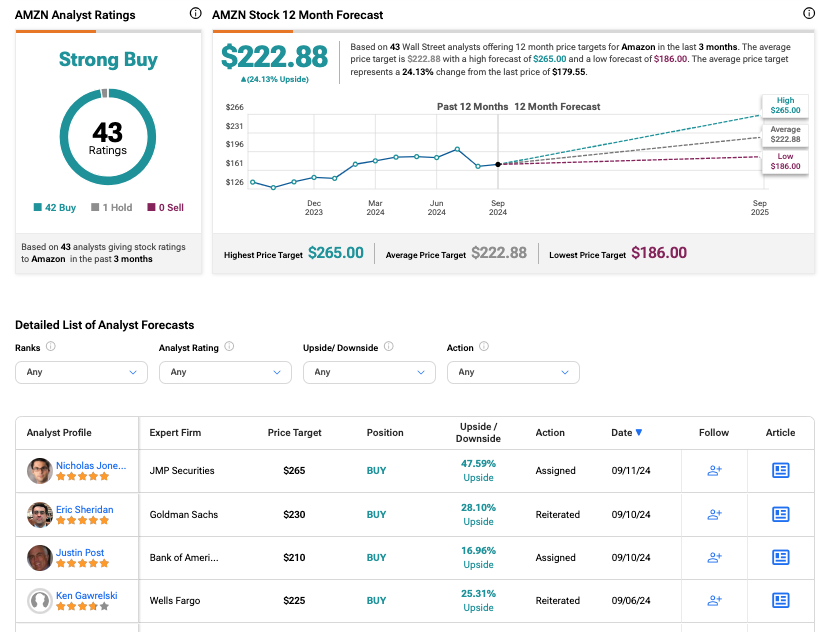

Is AMZN Stock a Buy, According to Analysts?

Turning to Wall Street, the general sentiment toward Amazon stock is strong. Amazon stock is currently rated a Strong Buy based on 42 Buy, one Hold rating, and zero Sell recommendations. Amazon’s average price is $222.88, which represents 25% from current levels.

The highest price target of $265 per share means the stock could see another 48% increase. Even the lowest price of $186 shows a moderate level from the current levels.

Check out some AMZN analyst data.

Highlights of Amazon Stock

Amazon stock is currently under correction but is expected to soon reach its $2 trillion market cap. The company consistently reports strong revenue growth in various segments and achieves high profitability.

To sum up, Amazon stands out as the leading online marketplace and cloud computing giant. Moreover, it is emerging as a leading player in online advertising and is poised to capture more market share in the coming years. I have confidence in Amazon stock, I expect it to continue to rise due to the company’s strength in many industries.

Notification

#AMZN #Stock #Poised #LongTerm #Rally #TipRanks.com